Grumbling about the IRS might as well be a national hobby. No matter what the political climate, any governmental agency that enforces the tax code is probably never going to rank as anyone’s favorite.

But is the agency any good at its job? How efficient is the IRS at collecting taxes? Does it spend more or less than it collects?

Those are questions USAFacts recently answered. But just for fun, if you had to guess, how much do you think the IRS spends to collect $100?

A. $89

B. $0.34

C. $44

D. $17

The answer is B. Surprised?

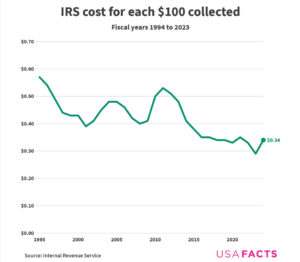

According to information from the IRS, reported by USAFacts, it cost the IRS 53 cents to collect every $100 in 2010. But by 2023, that amount dropped to 34 cents, a 36% improvement.

Here are a few other 2023 IRS tax facts:

- The agency’s 82,990 employees collected nearly $4.7 trillion in taxes, up 26% over the previous decade.

- The IRS spent $16.1 billion on operating expenses.

- Adjusted for inflation, IRS operating costs have fluctuated between $14 billion and $17 billion since the 1990s.

Check out more information about how taxes work here. While you’re at it, learn why everything’s still expensive, even though inflation is down.

And if you need help with the IRS, let us know.